Servicemembers aren’t authorized to possess significantly more than six discretionary allotments at any onetime. Under guidelines used by the DOD, effective January 1, 2015, servicemembers aren’t authorized to begin allotments for the purchase, rent, or leasing of individual home. Discretionary allotments for the purchase, rent, or leasing of individual home that began before 1, 2015, are grandfathered; amounts for such allotments may be changed but cannot be re-established once cancelled january GA installment loan. 49

The MLA legislation additionally forbids creditors, apart from armed forces welfare societies or solution relief communities, from requiring payment by allotment as a disorder to extending consumer that is certain to servicemembers and their dependents. 50 finance institutions should additionally be conscious that the buyer Financial Protection Bureau (CFPB) has pursued lots of enforcement actions alleging unjust, misleading, or abusive functions or methods associated with payment by army allotment. 51

EFFECTIVE COMPLIANCE MANAGEMENT METHODS TO SAFEGUARD SERVICEMEMBER RIGHTS

Banking institutions should build compliance that is effective systems to make sure that appropriate economic defenses are given to servicemember clients and their dependents. Standard bank administration should think about keeping written policies and procedures authorized because of the institution’s board of directors that outline the actions for staff to adhere to whenever responding to needs for monetary solutions from the servicemember or a servicemember’s dependents,as relevant. The institution’s policies would state where a clearly demand is routed, whom ratings it and authorizes benefits, and whom communicates your decision to your debtor in regards to the demand. These methods could either be stand- alone or included into existing wider procedures.

Active duty military personnel make permanent modification of section (PCS) moves about every two to four years. 53 A PCS may be the formal moving of an energetic duty army service user — along side any family unit members coping with her or him — to a new responsibility location, such as for instance a armed forces base. For army home owners, PCS orders which can be nonnegotiable and run under short timelines current challenges that are unique. Despite these challenges, armed forces home owners with PCS orders stay accountable for honoring their bills, including their mortgages.

In June 2012, the Board, customer Financial Protection Bureau, Federal Deposit Insurance Corporation, nationwide Credit Union management, and workplace for the Comptroller of this Currency, issued guidance to handle home loan servicing methods which could pose dangers to army home owners with PCS orders. The guidance, “Interagency assistance with Mortgage Servicing Practices Concerning Military Homeowners with Permanent Change of Station Orders” (Interagency PCS Guidance), talks about dangers pertaining to homeowners that are military have actually informed their loan servicer they own gotten PCS instructions and who look for help with their home loans. 54

The Interagency PCS Guidance analyzes institution that is financial home loan servicer reactions whenever a servicemember provides notice of a PCS. In order to avoid possibly deceptive or harming homeowners with PCS orders, home loan servicers (including banking institutions acting as home loan servicers) should: home loan servicers can help their efforts to follow along with this guidance by training workers in regards to the choices designed for property owners with PCS orders and adopting mortgage servicing policies and procedures that direct appropriate employee reactions to servicemembers assistance that is requesting.

Policies and procedures for MLA conformity

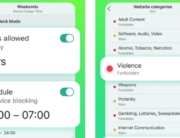

About the MLA, banking institutions needs to have appropriate policies and procedures set up, for instance: to recognize covered borrowers; satisfy disclosure demands; determine the MAPR for closed-end, charge card, along with other open-end credit services and products; and review credit rating agreements in order to avoid prohibited terms. Policies and procedures, for instance, should suggest that workers are to deliver covered borrowers having a declaration associated with the MAPR, any disclosure needed by Regulation Z, and a definite description regarding the re payment responsibility before or during the time that a debtor becomes obligated on a credit deal or establishes a credit account. The procedures would additionally detail the written and methods that are oral that your disclosures can be delivered.

Banking institutions may also be motivated to determine appropriate policies and procedures to determine the MAPR for closed-end and credit that is open-end (including bank card records) so the fees and costs that needs to be included and people which may be excluded are accounted for accordingly. Finance institutions would additionally excel to consider modification administration policies and procedures to gauge whether any contemplated fees that are new fees will have to be incorporated into MAPR calculations before these brand new charges or fees are imposed. Furthermore, banking institutions should think about just just how their staffs may efficiently monitor the MAPR regarding the open-end credit items and whether or not to waive costs or costs, either in entire or in component, to lessen the MAPR to 36 percent or below in an offered payment period or instead perhaps not impose charges and charges in a payment period which can be in excess of a 36 % MAPR (no matter if allowed underneath the relevant credit contract).

Other recommendations can include developing a listing of services and products wanted to servicemembers and their dependents — and possibly developing items and services particularly designed for servicemembers and their dependents, taking into consideration MLA limitations and MAPR requirements.